Property Deals for Smart Investors

Discover Exclusive Investment Opportunities Using The Airbnb Model

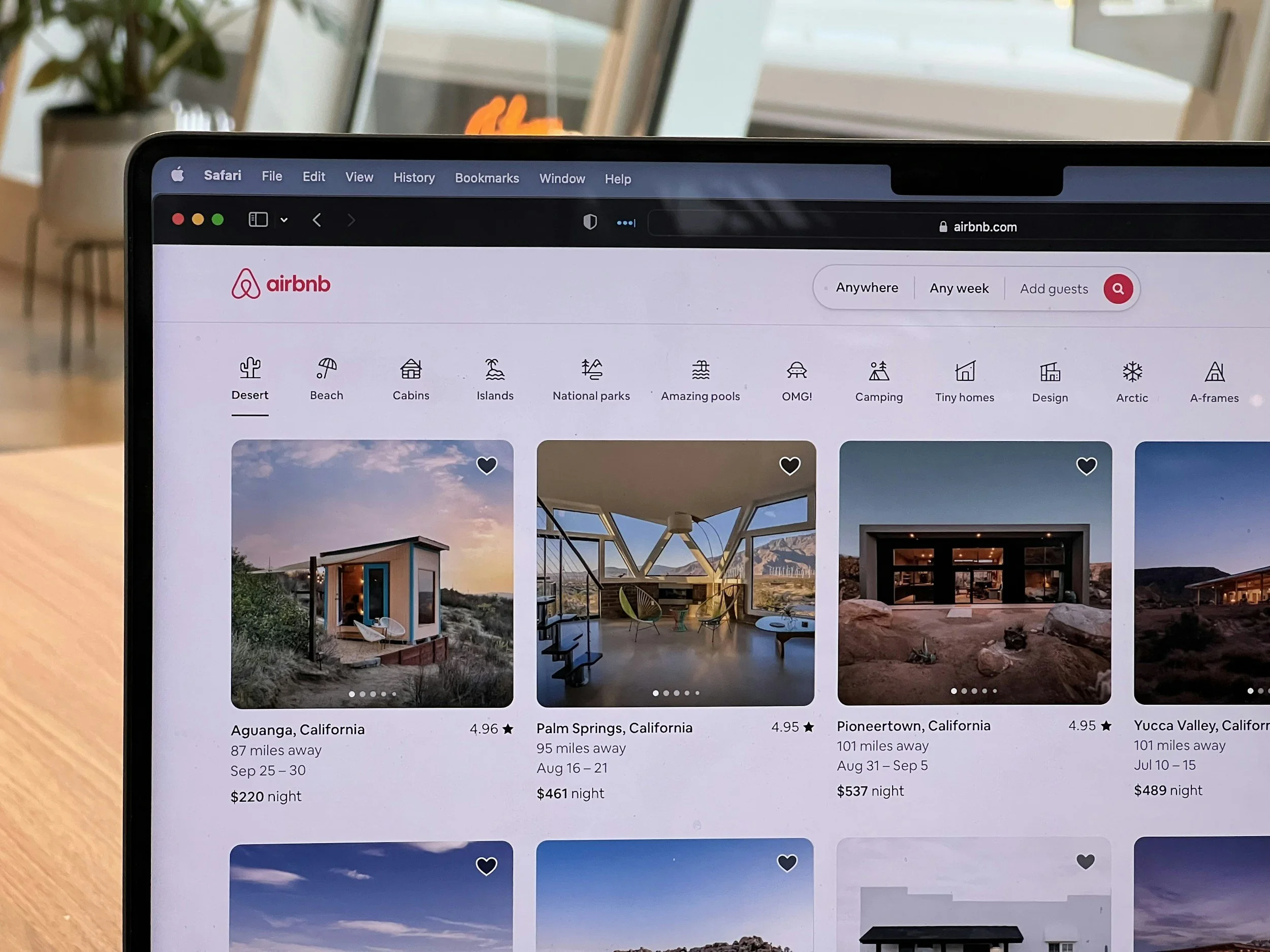

The Airbnb Model Explained

The Airbnb investment model focuses on generating income from property through short-term lets rather than traditional long-term tenancies. Properties are furnished, professionally managed, and marketed on platforms such as Airbnb and Booking.com to serve guests staying from a few nights to several weeks.

Unlike Buy-to-Let, which relies on a single tenant paying a fixed monthly rent, the Airbnb model benefits from nightly pricing, flexible stays, and higher income potential—particularly in strong UK locations such as city centres, commuter hubs, and leisure destinations.

Importantly, the Airbnb model is not limited to former guest houses or hotels. It can apply to any property where short-term lets are permitted under the lease, planning, and local regulations, including apartments, houses, and purpose-designed serviced accommodation.

Why Invest in the Airbnb Model?

The UK property market has evolved. Rising regulation, tax changes, and margin pressure have made traditional Buy-to-Let less attractive for many investors. At the same time, demand for short-term accommodation has surged.

The Airbnb model offers:

Strong demand from business travellers, contractors, tourists, and relocating professionals

Higher income potential compared to long-term rentals

Greater flexibility and control over your asset

A professional, hospitality-led approach to property investment

For investors seeking income-first property strategies, Airbnb has become a mainstream and proven model rather than a niche alternative.

Speak to Us About Airbnb-Led Property Investments

If you’re exploring Airbnb or short-term let opportunities and want clarity on whether this model aligns with your goals, we offer a no-obligation consultation.

We’ll help you:

Assess suitability for the Airbnb model

Understand income potential and risks

Explore professionally managed opportunities

Start a conversation today and see whether Airbnb-led investing is right for you.

Airbnb vs Buy-to-Let: A Strategic Shift

While Buy-to-Let focuses on stability through long-term tenants, Airbnb prioritises income optimisation and flexibility. Many investors now view Airbnb as a natural evolution of residential property investment rather than a replacement.

Key differences include:

Nightly income vs monthly rent

Hospitality management vs tenant management

Market-driven pricing vs fixed rent

Greater regulatory change risk—but also greater upside

The most successful investors choose the model that best aligns with their goals, risk tolerance, and time horizon.

Who Is the Airbnb Model Suitable For?

The Airbnb model is well suited to:

Investors seeking higher income rather than pure capital growth

Buy-to-Let landlords diversifying their portfolios

Professionals wanting hands-off, managed property investments

UK and international investors targeting strong UK locations

Investors planning medium to long-term holds (5+ years)

It may be less suitable for those seeking guaranteed fixed income or unwilling to work with professional operators.

Key Benefits of Airbnb Property Investment

Flexibility and Control

With short-term lets, you retain control of your property. You can:

Adjust pricing dynamically

Use the property yourself if desired

Switch strategies if market conditions change

This flexibility is not available in traditional assured shorthold tenancies.

Professional, Hands-Off Management

Modern Airbnb investing is typically fully managed, covering:

Guest communication

Cleaning and maintenance

Compliance and safety checks

Pricing optimisation

This makes the model suitable even for hands-off or remote investors.

Reduced Exposure to Long-Term Tenant Risk

Airbnb avoids many common Buy-to-Let challenges, including:

Rent arrears

Difficult evictions

Long void periods tied to single tenants

Income is diversified across many guests rather than relying on one household.

Strong Demand Fundamentals

Demand for short-term accommodation is driven by:

Growth in domestic and international travel

Hybrid working and longer stays

Contractor and corporate bookings

Pressure on hotel availability in many UK cities

Featured Airbnb Model Properties

-

Studio Apartment | Hoole Heights

Chester

Studio Apartment

17% NET Yield Achievable

High Corporate Demand

Price £50,000

-

2-Bed Apartment | The Swell

Rhosneigr

2-Bedroom Apartment

Furniture Included

Off-road Parking

Price £290,000

-

1-Bed Apartment | City Suites

Chester

1-Bedroom Apartment

8% NET Yield Achievable

City Centre Location

Price £160,000

Frequently Asked Questions (FAQs)

-

Yes, but rules vary by location. Some councils require planning consent or licensing. It is essential to invest only where short-term lets are permitted.

-

Income depends on location, property type, and management. Many UK Airbnb investments outperform Buy-to-Let on a gross yield basis, though returns are not guaranteed.

-

Not when professionally managed. Most investors choose fully managed solutions to remain hands-off.

-

Yes. Many investors combine Airbnb with serviced accommodation, corporate lets, or longer stays depending on demand.

Speak to Us About Airbnb-Led Property Investments

If you’re exploring Airbnb or short-term let opportunities and want clarity on whether this model aligns with your goals, we offer a no-obligation consultation.

We’ll help you:

Assess suitability for the Airbnb model

Understand income potential and risks

Explore professionally managed opportunities

Start a conversation today and see whether Airbnb-led investing is right for you.